Originally posted on https://www.huntergalloway.com.au/bridging-loan/

This guide will show you exactly what a bridging loan is.

Including how you can use it when buying and selling a property, and 3 new bridging finance case studies.

So if you are looking at upgrading to a new home, before selling your existing house this guide is for you.

Let’s get started.

Chapter 1. Bridging Loan Basics

So let’s assume you already own a property, want to move into a new home and want to do this before selling your existing property.

You may not want to sell your existing home and move twice.

This is when you need a bridging loan.

In this chapter, we’re going to go through what is a bridging loan and how you can use it.

Originally posted on YouTube by Mortgage Broker Brisbane – Hunter Galloway

What Does a Bridging Loan Mean?

Moving is stressful enough, let alone adding trying to buy a new property and sell your current one.

Selling a property can take much longer than expected, and if you’re relying on the money from the sale, then that adds extra pressure too.

This is where a bridging loan comes in.

Instead of having to rely on matching up settlement dates, a bridging loan covers the in-between period – loaning you money while you sell your current property and buy a new one.

Essentially, it will give you more time to sell your existing property which means that you can be fully moved into your new home before it’s even sold!

How Much Is a Bridging Loan?

Some banks will charge a higher interest rate if you are looking at getting a bridging loan. This can be an interest rate of 0%-1% higher. You also need to factor in the extra interest charges you will pay while you are holding both properties during the bridging period.

For instance, if it takes you 6 months your original property you will need to pay 6 months of interest – based on a 3.50% interest rate on a $500,000 loan this would cost you an extra $8,750.

We go through this in a detailed bridging loan scenario below.

Do I qualify for a bridge loan?

Before you start celebrating about how good bridging loans are; there are a few key things that you should be aware of.

These criteria will help you make sure you qualify for a bridging loan.

Income requirements – you can provide evidence of your income, employment and expenses – this process is as per a regular home loan refinance

Income requirements – you can provide evidence of your income, employment and expenses – this process is as per a regular home loan refinance You have equity– This varies between lenders, but as an idea having at least 20% equity will make the bridging loan possible.

You have equity– This varies between lenders, but as an idea having at least 20% equity will make the bridging loan possible. Maximum bridge term when purchasing an existing property – Some banks will provide a 3, 6 or 12 month bridging period – This is the maximum time frame you have to sell your old property.

Maximum bridge term when purchasing an existing property – Some banks will provide a 3, 6 or 12 month bridging period – This is the maximum time frame you have to sell your old property. Your current property must be on the market – While you might not have sold the property, for the banks to approve your bridging loan you must have put your existing home on the market to sell with a real estate agent.

Your current property must be on the market – While you might not have sold the property, for the banks to approve your bridging loan you must have put your existing home on the market to sell with a real estate agent.

There are also a few limitations to be aware of, including:

Not available for construction loans with SOME banks

Not available for construction loans with SOME banks Not available for strata title and company purchases

Not available for strata title and company purchases Some banks do not allow redraw during the bridging period and charge higher interest costs

Some banks do not allow redraw during the bridging period and charge higher interest costs

Now, these restrictions change from bank to bank.

Bridging finance may not be available to every borrower, and packages can vary, so it is best to speak with Hunter Galloway to confirm your eligibility.

Chapter 2. Proven Bridging Loan Types

In this chapter, I’m going to hand you the 2 proven bridging loan scenarios, and explain all the jargon you’re going to hear throughout the bridging process.

Including one detailed case study that will help you decide what type of bridging loan is right for you.

So if you are struggling to work out if bridging is right for you, these will come in handy.

How Do The Banks Calculate A Bridging Loan?

Regardless of the type of bridging loan, the banks will be calculating your figures based on two scenarios:

With an End Debt: This is common if you are upgrading your home, and assumes you will have a loan after you sell your existing property, and buy a new property.

With an End Debt: This is common if you are upgrading your home, and assumes you will have a loan after you sell your existing property, and buy a new property. With No End Debt: This is common if you are downgrading, or downsizing your home and assumes you will not have a loan after you have sold your existing property and bought a new one.

With No End Debt: This is common if you are downgrading, or downsizing your home and assumes you will not have a loan after you have sold your existing property and bought a new one.

In the case of a bridging loan with no end debt, the banks are not concerned with your income when there is no end debt because the sale of your original home completely pays out the banks loans.

This scenario only really happens when you are downgrading or downsizing your home to a smaller one.

The scenario with an end debt is the most common when you are looking at upgrading your home and so some banks will want to make sure you can afford the loan based on the end debt or final position after you’ve sold your existing home.

What type of bridging loan can I get?

There are two types of bridging loans that you can get: a closed or an open bridging loan.

An open bridging loan is when the sale of the current property hasn’t been finalised.

It is great for buyers who have found what they’re looking for but haven’t yet sold their property.

This is the most common scenario of bridging loan when you are either upgrading or downgrading your existing home which you haven’t quite sold yet.

A closed bridging loan is when you have a date agreed on for when your property will be sold

This gives the lender a clear outcome of when the remaining part of your bridging loan will be paid off.

This is a much less common type of bridging loan because if you have already agreed on a date to sell your existing property you could line up the settlement to happen simultaneously with the new home purchase.

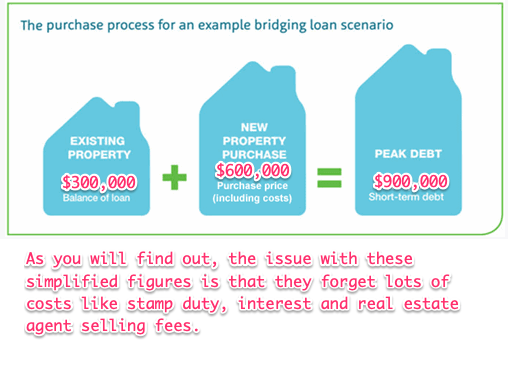

A simplified bridging loan case study

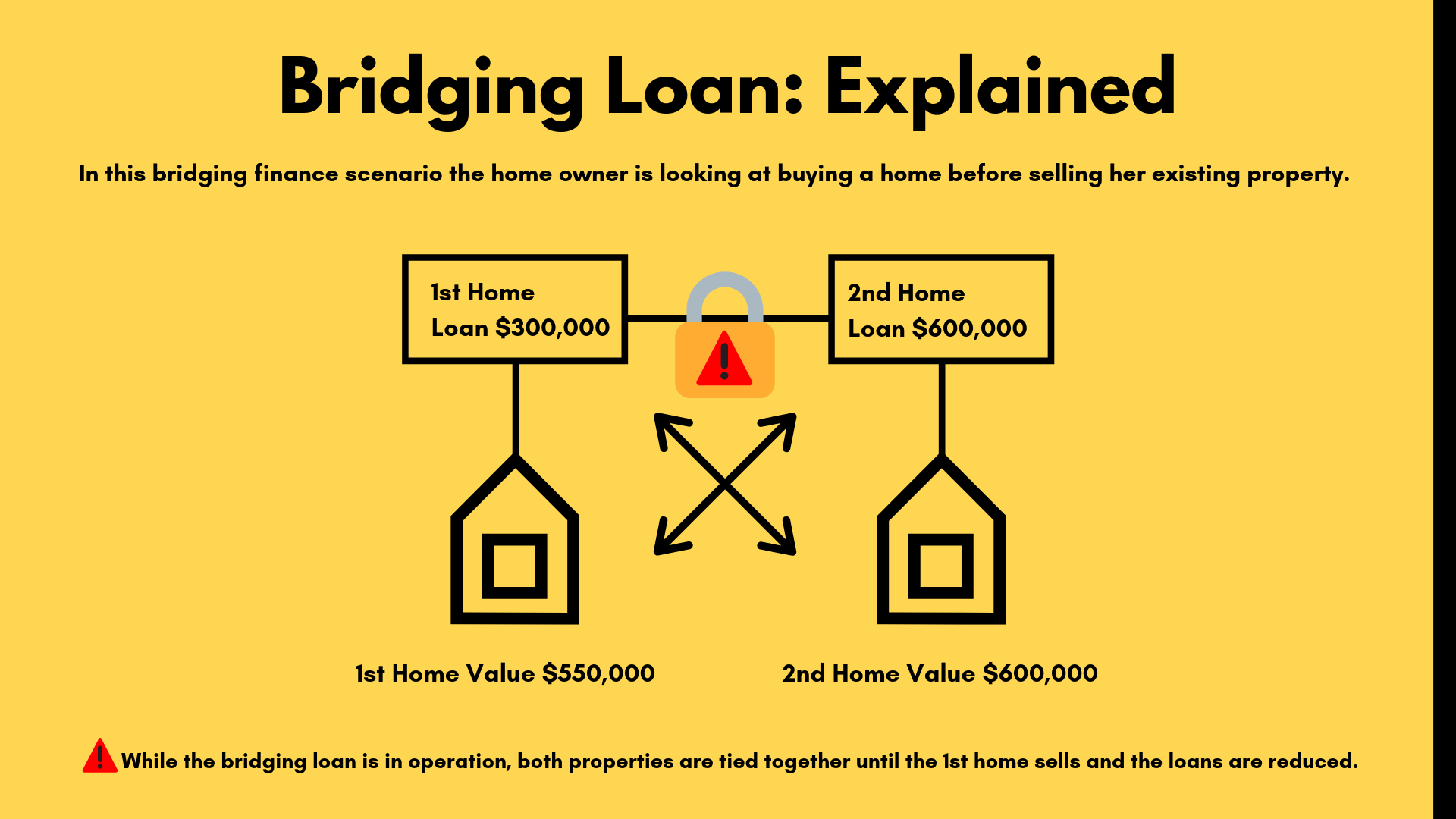

Camille wants to take out a bridging loan because she’s found the perfect home to move into but doesn’t want to be forced to quickly sell her existing home.

In the first instance, let’s go through the high-level figures and some of the jargon so you can understand how this will work.

Camille’s existing home is valued at $550,000 and wants to upgrade and buy a new home for $600,000.

Camille’s existing home is valued at $550,000 and wants to upgrade and buy a new home for $600,000. Her existing loan is $300,000 and she doesn’t want to contribute any savings and needs to borrow the full amount for the new property so $600,000.

Her existing loan is $300,000 and she doesn’t want to contribute any savings and needs to borrow the full amount for the new property so $600,000. To work out her peak debt, add them together: $300,000 + $600,000 = $900,000

To work out her peak debt, add them together: $300,000 + $600,000 = $900,000

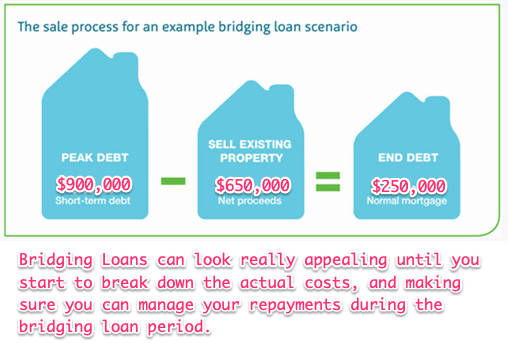

Camille eventually sells her existing home for $650,000

Camille eventually sells her existing home for $650,000 This leaves her ongoing loan balance as: $900,000 – $650,000 = $250,000

This leaves her ongoing loan balance as: $900,000 – $650,000 = $250,000

The benefit of a bridging loan for Camille is that she doesn’t need to be in a rush to sell her existing home, and that extra time helped he sell her original home for $50,000 more than the bank had valued it at!

Now keep in mind these figures are very rough, we aren’t taking into consideration real estate agents fees, interest costs and stamp duty which we will go through now.

A comprehensive bridging loan case study

Let’s look at that existing scenario again, taking into consideration all costs and charges.

Camille’s existing home is valued at $550,000 and wants to buy a new home for $600,000.

Camille’s existing home is valued at $550,000 and wants to buy a new home for $600,000. Her existing loan is $300,000 and she would like to borrow the full amount for the new property and stamp duty.

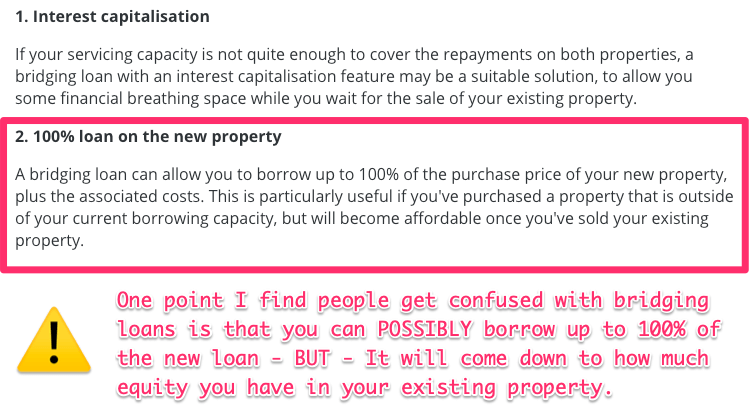

Her existing loan is $300,000 and she would like to borrow the full amount for the new property and stamp duty. In Camille’s scenario, she couldn’t afford to make repayments on the peak debt so would like to add the interest to the loan during the bridging period. This is also known as capitalising interest.

In Camille’s scenario, she couldn’t afford to make repayments on the peak debt so would like to add the interest to the loan during the bridging period. This is also known as capitalising interest. We also need to factor in selling costs to pay the real estate agent, and stamp duty costs on the new purchase.

We also need to factor in selling costs to pay the real estate agent, and stamp duty costs on the new purchase.

So in the real world, this scenario would be a little bit different.

- Camille would still like to borrow $600,000 towards the new property and owes $300,000 on her existing property = $900,000

Additional costs to factor into a bridging loan:

Additional costs to factor into a bridging loan:

Stamp Duty on new Purchase (QLD) = $14,746

Stamp Duty on new Purchase (QLD) = $14,746 Plus 12 months interest during Bridging Loan = $24,482*

Plus 12 months interest during Bridging Loan = $24,482*

- Total Peak Debt = $939,228

*Keep in mind the bank will calculate 12 months interest, but only charge you for the interest that you need. In other words, if you sell the property within 3 months, you will only pay 3 months worth of interest.

Then to work out what the end loan would be, we need to factor some of the costs on the sale of the property.

The banks include a fairly large buffer in here in case the property sells for less, or the selling costs blow out a little.

- Valuation of existing home $550,000 (bank will work on this figure, as we don’t know what the property will sell for in the future at this stage).

- Plus 15% margin (a just in case margin the bank puts in) = $82,500

- Plus selling costs $15,750

- End debt = $487,478

If it ends up being the case Camille sells the property for $650,000 instead of $550,000 (which is what the bank had valued the property) the end debt would be $100k less or $387,478.

With the bridging loan’s peak debt going over 80% LVR you would have to pay LMI on this amount, which would cost an additional $8,600.

How Can You Avoid LMI On a Bridging Loan?

The only way to avoid this would be keeping the LVR under 80% during the bridging period.

(Yes, LMI is calculated on the PEAK debt – your maximum borrowing amount – not the END debt)

In Camille’s scenario, this would be possible by:

- 1. Contributing $20,000 towards reducing the loan amount or

- 2. Looking at a lower-priced property to upgrade into.

- 3. Getting a higher valuation on her existing property

Get in touch with our team of mortgage brokers to run your bridging loan scenario, our team are experts and can give you options across various banks or call us on 1300 088 065.

Chapter 3. Bridging Loan Checklist

Do you need to find the right loan type for your situation? Yes.

Does it suit everyone?

No.

In fact, we’ll walk you through the exact bridging checklist to make sure you can even qualify.

And If you’re looking to find out if you can get a bridging loan quickly, then this chapter is for you.

Let’s dive in.

Bridging Loan Checklist

Bridging loans are similar to regular home loans in that the bank needs to hold a property as security, and they need to make sure you can afford the loan repayments in any scenario.

These loans are perfect for any homebuyers who want to purchase a new home before selling your existing home provided you meet the bank’s criteria:

Is the Property being sold In a Metro Area (i.e. not regional) – Yes/No

Is the Property being sold In a Metro Area (i.e. not regional) – Yes/No Have you been in your job for at least 3 months – Yes/No

Have you been in your job for at least 3 months – Yes/No Do you have more than 20% equity in your existing home – Yes/No

Do you have more than 20% equity in your existing home – Yes/No Is the maximum peak debt LVR 90% or less – Yes/No

Is the maximum peak debt LVR 90% or less – Yes/No Will there be an end debt – Yes/No

Will there be an end debt – Yes/No Can you afford to make repayments on the end debt – Yes/No

Can you afford to make repayments on the end debt – Yes/No Is there One Property Being Sold – Yes/No

Is there One Property Being Sold – Yes/No Do you have evidence the property is being listed to be sold – Yes/No

Do you have evidence the property is being listed to be sold – Yes/No Do you plan on selling your existing home within 12 months or less – Yes/No

Do you plan on selling your existing home within 12 months or less – Yes/No

If you answered yes to these questions you are more than likely able to qualify for a bridging loan.

There are some banks that can help if you have less than 20% equity in your existing property, but you will have to pay lenders mortgage insurance on the peak debt amount.

To discuss your bridging loan scenario, speak with our Mortgage Brokers and see how you can upgrade your home without having to sell today.

Good and the bad of Bridging Loans

As you’ve seen so far bridging loans are good for some, and not as great for others.

Here is our comprehensive list of the pros, and the cons of bridging loans.

Pros of a bridging loan

Flexibility to buy a property immediately without waiting for a loan

Flexibility to buy a property immediately without waiting for a loan Capitalised Interest is possible, so you will only need to maintain repayments on the end loan and not be stressed with two mortgages.

Capitalised Interest is possible, so you will only need to maintain repayments on the end loan and not be stressed with two mortgages. Time to wait for the right buyer on your current property, instead of having to settle for a quick sale.

Time to wait for the right buyer on your current property, instead of having to settle for a quick sale. Saves you from having to move into a rental while you wait to find a new home to buy.

Saves you from having to move into a rental while you wait to find a new home to buy. Unlimited P&I repayments. If you want to reduce your interest, you can make repayments on the loan if you wish.

Unlimited P&I repayments. If you want to reduce your interest, you can make repayments on the loan if you wish. Depending on the bank, you will only pay standard fees and charges compared to a regular home loan. There are no additional discharge fees or break costs.

Depending on the bank, you will only pay standard fees and charges compared to a regular home loan. There are no additional discharge fees or break costs.

Cons of a bridging loan

Two valuations are required – both your current property and the new property that you want to buy will need to be valued, costing between $200-220

Two valuations are required – both your current property and the new property that you want to buy will need to be valued, costing between $200-220 Paying interest on two properties while you sell, calculates daily and charges to the loan monthly. So if your property takes a long time to sell, more interest will accrue.

Paying interest on two properties while you sell, calculates daily and charges to the loan monthly. So if your property takes a long time to sell, more interest will accrue. Not selling the property on time can be a sting. Higher interest rates can occur and you’ll need to pay P&I on peak debt to service the loans if it takes you more than 6-12 months to sell the property. This can cause financial stress.

Not selling the property on time can be a sting. Higher interest rates can occur and you’ll need to pay P&I on peak debt to service the loans if it takes you more than 6-12 months to sell the property. This can cause financial stress. No redraw facility is available

No redraw facility is available Cannot switch lenders during the bridging loans.

Cannot switch lenders during the bridging loans.

To discuss your bridging loan scenario, speak with our Mortgage Brokers and see how you can upgrade your home without having to sell today.

Chapter 4. Best Bridging Loans in Australia

Now that you know what you want, it’s time to find the right lender for you.

And in this chapter, I’m going to show you exactly how to find the perfect bank for you.

(Including lots of advanced tips and strategies that I’ve learned from years of being a mortgage broker).

Let’s jump in.

Bridging Bank Home Loans

Not all banks can offer bridging loans, and the ones that do bridging loans all call them by different names.

We’ve broken down the different banks and the names that they refer to them by.

Some of these banks require a minimum of 50% equity in your existing property, so chat to our Mortgage Brokers to understand what bank will best suit you on 1300 088 065.

| Bank | Bridging Loan Name | Description |

| Bank Of QLD | Bridging Finance Loan |

|

| BOQ Specialist | Case by case |

|

| Bank Australia | Bridging Loan |

|

| Commonwealth Bank | CBA Bridging Finance |

|

| Heritage Bank | Bridging Loan |

|

| People Choice Credit Union | Bridging Loan |

|

| Gateway Credit Union | Not available |

|

| ING Bank | Bridging Finance |

|

| NAB | Bridging Loan |

|

| St George Bank | Relocation Loan |

|

| Suncorp Bank | Not Available |

|

| Westpac | Bridging Home Loan |

|

While all these banks offer bridging loans, they all come with different costs and pros.

As I mentioned the best bank for you will come down to your individual situation, speak with our team of Mortgage Brokers to understand what bank will best suit you.

Chapter 5. Bridging Loan Case Studies

In this chapter, we’ll cover some real-life bridging case studies.

We’ll put together all the terms and jargon into a few real-life case studies.

Let’s go.

Upgraders Bridging Loan Case Study: Family has outgrown the home

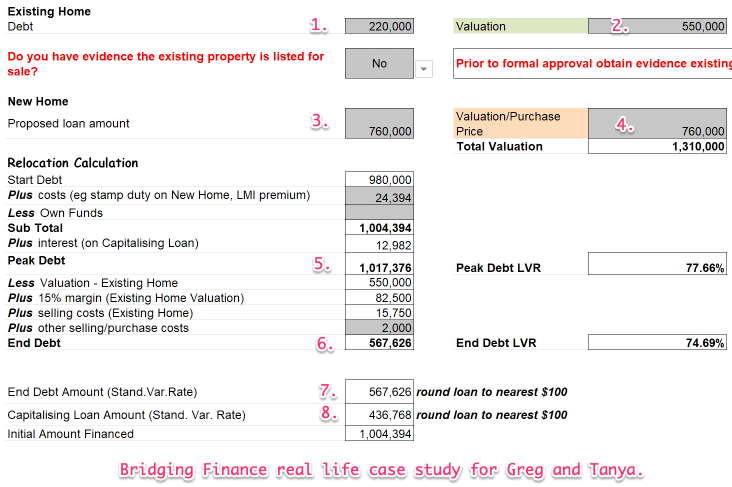

Tanya and Greg bought their home when they first got married, but three kids later they were starting to run out of space.

They had also found the perfect home to move into, but having lived in their existing home for over 10 years they knew it needed a bit of paint before putting it on the market.

Greg had some mates that could come around and tidy up their existing home for a fraction of the price if they had some time to get everything done so bridging seemed like the right option.

(Plus Tanya hated moving, so she wanted to move once and only once into the new home)

How a Bridging Loan Made Sense

Tanya and Greg had concerns about having to manage two mortgages while Greg took his time to tidy up their old place.

We were able to look at a lender that capitalised or added the interest during the bridging loan period which means they weren’t going to put under mortgage stress.

The other benefit was Greg and Tanya didn’t need to move out to a rental house and waste money on that while they found a new home to move into.

Win-Win.

Let’s look at the numbers behind with the bridging finance calculator

Tanya and Greg’s existing home was valued by the bank at $550,000 and they had found a new home to purchase for $760,000

They already had chosen a real estate agent and knew they could sell their existing home easily within 6 months.

They wanted to be able to borrow the full amount towards the new purchase of $760,000.

- 1. Existing Home Loan $220,000

- 2. Existing Home Valued $550,000

New purchase

- 3. New Purchase Home Loan $760,000

- 4. New Home Value $760,000

This is when some of our bridging finance terms come in

- 5. Peak Debt $1,017,376 (this includes capitalised interest, and costs)

- 6. End Debt $567,626

And then the bank will split this up as follows to make it easy to clear the loans once the original property is sold

- 7. End Debt $567,626 (this is the loan that will remain)

- 8. Capitalising loan amount $436,768 (this loan is cleared when their original property is sold)

The benefit of this structure is that Greg & Tanya are only making repayments on the end debt of $567,626 from the settlement.

Which is only $1,176 per fortnight, compared to if they had to make the repayments on the peak debt (which would be $2,108 per fortnight!).

Once the Original Property Was Sold

The great news is their original property sold for $556,000 meaning their capitalising loan of $436,768 was cleared and the extra funds were paid towards their end debt to save interest!

Common issues we see

Sellers always overestimate how much their existing property is going to sell for, and then fall short of the payment for the bridging loan.

So be aware of this and do adequate research around sales in the market at the moment.

Another issue we see is that sellers struggle to sell their property within the bridging period, adding extra stress and costs to the loan.

As I mentioned above, not all banks will require you to make repayments on the peak debt during the bridging loans.

Make sure you are aware of what your bank offers before going down the bridging loan path.

Read More: How to accurately value property with a FREE RP Data report

Chapter 6. Advanced Bridging Loan Strategies and Techniques

There are four main points to be aware of when it comes to borrowing on a bridging loan.

In this chapter, we break these down and give a quick recap on bridging finance terms.

How Much Can I borrow Using a Bridging Loan?

1. Existing Equity In Your Home

Usually, lenders will add an interest rate buffer of six months to assess your ability to pay off the bridging loan. When it comes to adding a buffer, the property that is being sold will be reduced by 15% as a “fire sale” buffer as the projected sale.

This lower price can have an impact on your borrowing power, as the lender will be considering a property price lower than your projected outcome to maintain a conservative approach.

2. Will You Have An End Debt

If you are upgrading your home, it is likely you will have some lending left over after you sell your original property.

3. What the Peak Debt Will Be

Your peak debt is the combination of your new property price plus the what’s left of your current mortgage. Once you have this, on average you will be able to borrow up to 90% of the combined property values.

Current mortgage + New property mortgage = Total peak Debt

4. Existing Property On Market

Most banks will want to see evidence you have listed your existing home for sale on the market, either by an engagement letter from a real estate agent, draft contract of sale or seeing the property listed online.

Wait, I don’t understand how bridging loans actually work?

Let’s take a few steps back and outline it simply.

A bridging loan is getting finance to fill in the gap for you between buying and selling a property.

So instead of selling a property and waiting for that money to come through, you’ll have finance before and then can pay it back.

You will need a valuation in order to get the figures for your existing home and your new home. And your peak debt will be worked out.

- Current mortgage + New property price = Total peak Debt

Your eligibility will be assessed and then this figure left is called an “ongoing balance” which is the principal of the loan.

Both properties will be used as security but the loan will be combined as one.

During this interim, many lenders allow interest only repayments on the peak debt so that you can hold on paying principal and interest repayments and not need to manage two loans.

Once the property is sold, your repayments will begin as normal and any compounded bridge loan interest will be added to your new loan.

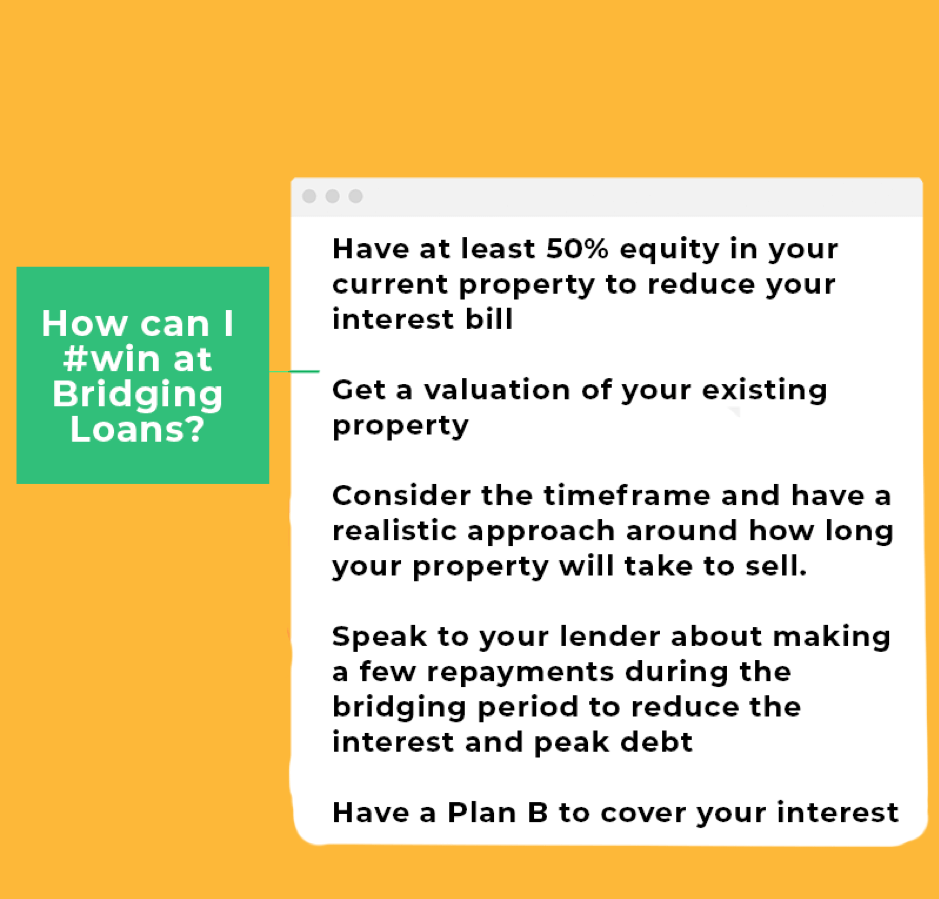

How can I #win at Bridging Loans?

Follow these steps….

Have at least 20-40% equity in your current property to make bridging possible

Have at least 20-40% equity in your current property to make bridging possible Get a valuation of your existing property, research; and be realistic about how much it will sell for.

Get a valuation of your existing property, research; and be realistic about how much it will sell for. Consider the timeframe and have a realistic approach around how long your property will take to sell. Remember settlement alone can take 6 to 8 weeks.

Consider the timeframe and have a realistic approach around how long your property will take to sell. Remember settlement alone can take 6 to 8 weeks. Speak to your lender about making a few repayments during the bridging period to reduce the interest and peak debt

Speak to your lender about making a few repayments during the bridging period to reduce the interest and peak debt Have a Plan B to cover your interest while you’re trying to sell – can you get short term tenants in your property for extra income or can you move back home or at a friend for a little while to save money?

Have a Plan B to cover your interest while you’re trying to sell – can you get short term tenants in your property for extra income or can you move back home or at a friend for a little while to save money?

What can I do instead of a bridging loan?

If you don’t want to take out a bridging loan you can wait and sell your current property first, rent or stay with family in the interim and then buy a new property.

Or you could turn your existing home into an investment property.

Hunter Galloway can help you do an estimate of the costs of bridging finance against other options. Speak to us today on 1300 088 069.